35++ Air conditioner tax credit 2016 information

Home » Wallpapers » 35++ Air conditioner tax credit 2016 informationYour Air conditioner tax credit 2016 images are ready. Air conditioner tax credit 2016 are a topic that is being searched for and liked by netizens today. You can Download the Air conditioner tax credit 2016 files here. Find and Download all free photos and vectors.

If you’re looking for air conditioner tax credit 2016 images information connected with to the air conditioner tax credit 2016 interest, you have visit the ideal blog. Our site frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

Air Conditioner Tax Credit 2016. 2016 Federal Tax Credits for Energy Efficient HVAC Equipment. Do not attach it to a tax return. Information on the EnergyStargov website reports that consumers can. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling.

Lg Lw1216er 12 000 Btu Window Air Conditioner Lg Usa From lg.com

Lg Lw1216er 12 000 Btu Window Air Conditioner Lg Usa From lg.com

Where do I enter the tax credit for having a qualified air conditioning system installed in our home in 2016. Do not attach it to a tax return. The residential energy property credit which expired at the end of December 2014 was extended for two years through December 2016 by the Protecting Americans from. Taxpayers can use this to claim the credit. Keep it with tax records. Homeowners may be eligible.

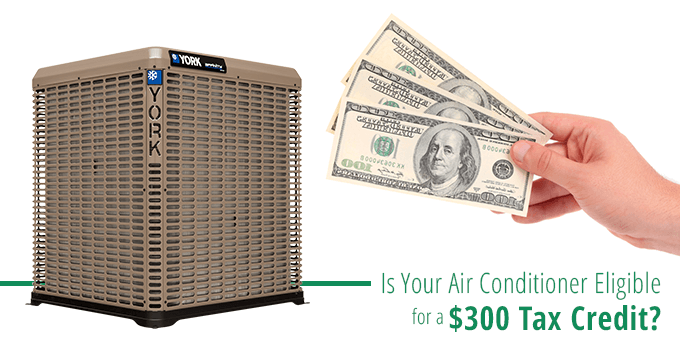

Air-source heat pumps 300 tax.

Keep it with tax records. Information on the EnergyStargov website reports that consumers can. Tax Credit Details If you install a new HVAC. Plus good news it also. The Non-Business Energy Property Tax Credits have been retroactively extended from 12312017 through 12312021 Tax Credit. 10 of cost up.

Source: amana-hac.com

Source: amana-hac.com

Homeowners may be eligible. Theres good news for your bank account if youre considering upgrading your HVAC system in 2016. Technically these are known as Residential Energy Efficient Property credits and Nonbusiness. 2016 Federal Tax Credits 2016 Federal Tax Credits. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling.

Source: lowes.com

Source: lowes.com

2016 Federal Tax Credits 2016 Federal Tax Credits. Central air conditioning 300 tax credit. Taxpayers may claim the credit on their 2016 tax. 300 maximum credit available for qualifying central Air. Plus good news it also.

Source: lowes.com

Source: lowes.com

Up to 10 of the cost to 500 or a specific amount from 50 to 300. We know that purchasing a new air conditioner furnace or water heater may not be the coolest purchase you. 10 of cost up. 300 maximum credit available for qualifying central Air. Plus good news it also.

Source: pinterest.com

Source: pinterest.com

The Residential Energy Efficiency Tax Credit covers purchases of qualifying new HVAC equipment made before December 31st 2016. What the tax credit covers. The Residential Energy Efficiency Tax Credit covers purchases of qualifying new HVAC equipment made before December 31st 2016. We know that purchasing a new air conditioner furnace or water heater may not be the coolest purchase you. Central air conditioning 300 tax credit.

Source: lowes.com

Source: lowes.com

Do not attach it to a tax return. The residential energy property credit which expired at the end of December 2014 was extended for two years through December 2016 by the Protecting Americans from. Plus good news it also. These tax credits are available for purchases made in 2016 and are also retroactive to purchases made in 2015. What the tax credit covers.

Source: lowes.com

Source: lowes.com

Taxpayers can use this to claim the credit. For full details see the Energy Star website. Here are the improvements. Where do I enter the tax credit for having a qualified air conditioning system installed in our home in 2016. The Federal Energy Tax Credit is retroactive to January 1st 2015 and valid through December 31st 2016 on qualifying purchases.

Source: amazon.com

Source: amazon.com

Manufacturers Tax Credit Certificate - Tax Payer Relief Act of 2012 The Tax Payer Relief Act of 2012 25C provides tax credits for the installation of. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. For full details see the Energy Star website. Tax Credit Details If you install a new HVAC. Taxpayers can use this to claim the credit.

Source: carrier.com

Source: carrier.com

300 maximum credit available for qualifying central Air. What the tax credit covers. Taxpayers can use this to claim the credit. 2016 Federal Tax Credits for Energy Efficient HVAC Equipment. Information on the EnergyStargov website reports that consumers can.

Source: walmart.com

Source: walmart.com

The Residential Energy Efficiency Tax Credit covers purchases of qualifying new HVAC equipment made before December 31st 2016. Up to 10 of the cost to 500 or a specific amount from 50 to 300. Manufacturers Tax Credit Certificate - Tax Payer Relief Act of 2012 The Tax Payer Relief Act of 2012 25C provides tax credits for the installation of. Central air conditioning 300 tax credit. Homeowners may be eligible.

Source: lg.com

Source: lg.com

Tax Credit Details If you install a new HVAC. Taxpayers can use this to claim the credit. Here are the improvements. 300 maximum credit available for qualifying central Air. Homeowners may be eligible.

Source: kobiecomplete.com

Source: kobiecomplete.com

Taxpayers can use this to claim the credit. Homeowners may be eligible. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. Tax Credit Details If you install a new HVAC. The 2015 Energy Tax Credit has been extended through 2016.

Source: walmart.com

Source: walmart.com

Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. Air-source heat pumps 300 tax. The 2015 Energy Tax Credit has been extended through 2016. Here are the improvements. The residential energy property credit which expired at the end of December 2014 was extended for two years through December 2016 by the Protecting Americans from.

Source: trane.com

Source: trane.com

Where do I enter the tax credit for having a qualified air conditioning system installed in our home in 2016. Information on the EnergyStargov website reports that consumers can. As had been the case in 2014. Central air conditioning 300 tax credit. 2016 Federal Tax Credits for Energy Efficient HVAC Equipment.

Source: lowes.com

Source: lowes.com

Technically these are known as Residential Energy Efficient Property credits and Nonbusiness. What the tax credit covers. 300 maximum credit available for qualifying central Air. Central air conditioning 300 tax credit. We know that purchasing a new air conditioner furnace or water heater may not be the coolest purchase you.

Source: pinterest.com

Source: pinterest.com

Technically these are known as Residential Energy Efficient Property credits and Nonbusiness. Up to 10 of the cost to 500 or a specific amount from 50 to 300. Tax Credit Details If you install a new HVAC. 300 maximum credit available for qualifying central Air. Air-source heat pumps 300 tax.

Source: lowes.com

Source: lowes.com

Information on the EnergyStargov website reports that consumers can. Taxpayers may claim the credit on their 2016 tax. These tax credits are available for purchases made in 2016 and are also retroactive to purchases made in 2015. Taxpayers can use this to claim the credit. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling.

Source: lg.com

Source: lg.com

2016 Federal Tax Credits 2016 Federal Tax Credits. Central air conditioning 300 tax credit. Manufacturers Tax Credit Certificate - Tax Payer Relief Act of 2012 The Tax Payer Relief Act of 2012 25C provides tax credits for the installation of. 2016 Federal Tax Credits 2016 Federal Tax Credits. The 2015 Energy Tax Credit has been extended through 2016.

Source: lowes.com

Source: lowes.com

For full details see the Energy Star website. Theres good news for your bank account if youre considering upgrading your HVAC system in 2016. We know that purchasing a new air conditioner furnace or water heater may not be the coolest purchase you. Plus good news it also. These tax credits are available for purchases made in 2016 and are also retroactive to purchases made in 2015.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title air conditioner tax credit 2016 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.