18+ Air conditioner useful life depreciation info

Home » Background » 18+ Air conditioner useful life depreciation infoYour Air conditioner useful life depreciation images are available. Air conditioner useful life depreciation are a topic that is being searched for and liked by netizens now. You can Get the Air conditioner useful life depreciation files here. Download all free vectors.

If you’re looking for air conditioner useful life depreciation pictures information connected with to the air conditioner useful life depreciation interest, you have pay a visit to the right blog. Our website frequently gives you suggestions for viewing the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

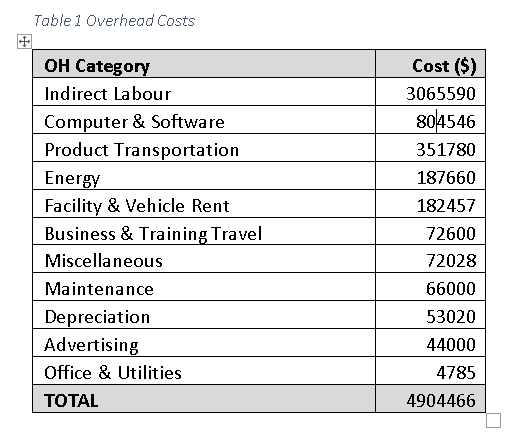

Air Conditioner Useful Life Depreciation. This problem is the most widespread in my opinion and can be. As for depreciation if they are part of the central HVAC system you have to depreciate them over 275 years. Guide to Expensing HVAC Costs Diana Vu 2021-04-20T080139-0700. Heating ventilation and air.

Get A Big Tax Break When You Replace An R22 Air Conditioner From aristair.com

Get A Big Tax Break When You Replace An R22 Air Conditioner From aristair.com

Added a new air conditioner to a rental property. If an AC was purchased at Rs40000 and had a useful life of 4 years and has a salvageable value of Rs4000 then the depreciation will be charged as follows. Evaporators can be used to absorb heat from air or from a liquid. The table specifies asset lives for property subject to depreciation under the. However 168e3Eiv provides that 15-year property includes QLIP. Anytime you replace or repair an item inside a rental unit there are two general financial options to consider.

HVAC now qualifies for Section 179 expense deduction.

However in order to take advantage of it your property will. This is called the assets class life. Added a new air conditioner to a rental property. Air handler used to. What is Air Conditioner Depreciation. Ancillary assets including building and services assets.

Source: irishheatandair.com

Source: irishheatandair.com

However air conditioning and heating systems do qualify as section. Air handler used to. Fire protection and alarm systems. The total cost of the equipment and labor for installation is 14000. HVAC now qualifies for Section 179 expense deduction.

Source: thisoldhouse.com

Source: thisoldhouse.com

The table specifies asset lives for property subject to depreciation under the. The table specifies asset lives for property subject to depreciation under the. Heating ventilation and air. Air handler used to. Guide to Expensing HVAC Costs Diana Vu 2021-04-20T080139-0700.

Source: pinterest.com

Source: pinterest.com

The changes made by the TCJA apply to property. Generally including air conditioning. A business owner installs a new heating and air-conditioning rooftop unit. Depreciation is reported on IRS Form 4562. Friends As per Schedule II to CA 2013 Air Conditioner should be classified as Office Equipment or Plant Machinery If PM will it be in the useful life of 15 years.

Source: kandsac.com

Source: kandsac.com

Depreciation is reported on IRS Form 4562. HVAC now qualifies for Section 179 expense deduction. As for depreciation if they are part of the central HVAC system you have to depreciate them over 275 years. The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674. Depreciation is reported on IRS Form 4562.

Source: pinterest.com

Source: pinterest.com

This problem is the most widespread in my opinion and can be. Friends As per Schedule II to CA 2013 Air Conditioner should be classified as Office Equipment or Plant Machinery If PM will it be in the useful life of 15 years. Guide to Expensing HVAC Costs Diana Vu 2021-04-20T080139-0700. However 168e3Eiv provides that 15-year property includes QLIP. Ancillary assets including building and services assets.

Source: pinterest.com

Source: pinterest.com

Air handler used to. Metal stamping and blanking assets. Evaporators can be used to absorb heat from air or from a liquid. As for depreciation if they are part of the central HVAC system you have to depreciate them over 275 years. Guide to Expensing HVAC Costs Diana Vu 2021-04-20T080139-0700.

Source: sandermechanical.com

Source: sandermechanical.com

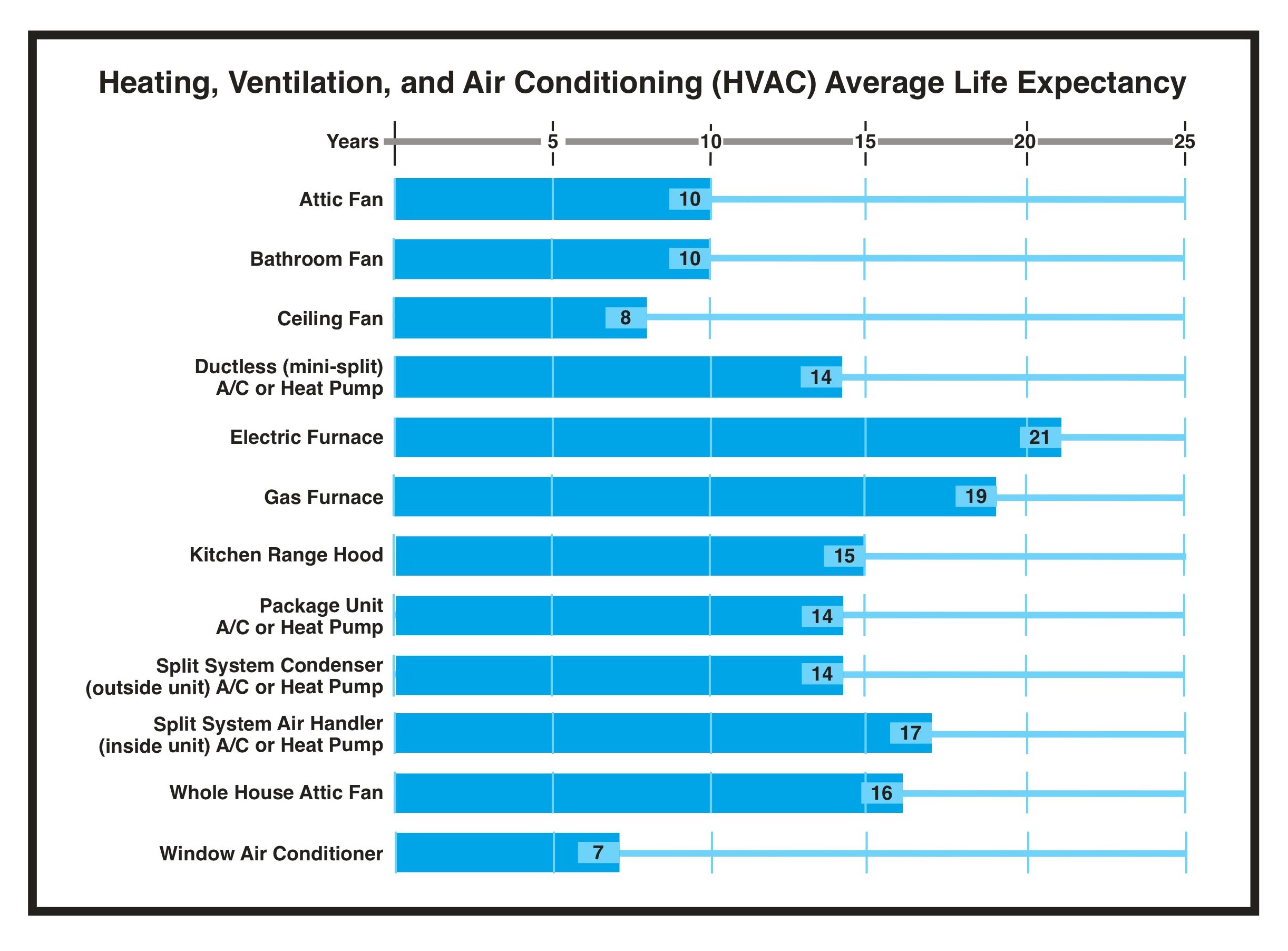

Friends As per Schedule II to CA 2013 Air Conditioner should be classified as Office Equipment or Plant Machinery If PM will it be in the useful life of 15 years. As for depreciation if they are part of the central HVAC system you have to depreciate them over 275 years. Residential rental property or property with a class life of less than 275 years. The IRS determines the useful lives of different types of assets. Depreciation for HVAC in 2020.

Source: avsheatingandair.com

Source: avsheatingandair.com

Heating ventilation and air-conditioning property HVAC. As featured in AICPA Tax Adviser April 15 2021. Problems with air conditioners can have many reasons. Heating ventilation and air. Residential rental property or property with a class life of less than 275 years.

Source: scottsdaleair.com

Source: scottsdaleair.com

The table specifies asset lives for property subject to depreciation under the. Air handler used to. However 168e3Eiv provides that 15-year property includes QLIP. The changes made by the TCJA apply to property. The IRS determines the useful lives of different types of assets.

Source: howtolookatahouse.com

Source: howtolookatahouse.com

However in order to take advantage of it your property will. Heating ventilation and air-conditioning property HVAC. Depreciation for HVAC in 2020. The table specifies asset lives for property subject to depreciation under the. Metal stamping and blanking assets.

Source: aristair.com

Source: aristair.com

The table specifies asset lives for property subject to depreciation under the. Added a new air conditioner to a rental property. Fire protection and alarm systems. Anytime you replace or repair an item inside a rental unit there are two general financial options to consider. This is called the assets class life.

Source: accidentalrental.com

Source: accidentalrental.com

The simple answer to this question is no HVAC systems do not qualify for bonus depreciation. Friends As per Schedule II to CA 2013 Air Conditioner should be classified as Office Equipment or Plant Machinery If PM will it be in the useful life of 15 years. Air handler used to. However air conditioning and heating systems do qualify as section. As for depreciation if they are part of the central HVAC system you have to depreciate them over 275 years.

Source: pinterest.com

Source: pinterest.com

However 168e3Eiv provides that 15-year property includes QLIP. Fire protection and alarm systems. The IRS determines the useful lives of different types of assets. Evaporators can be used to absorb heat from air or from a liquid. Generally including air conditioning.

Source: chegg.com

Source: chegg.com

Guide to Expensing HVAC Costs Diana Vu 2021-04-20T080139-0700. So the first one is a problem with a filter. Anytime you replace or repair an item inside a rental unit there are two general financial options to consider. The changes made by the TCJA apply to property. Ancillary assets including building and services assets.

Source: pinterest.com

Source: pinterest.com

The table specifies asset lives for property subject to depreciation under the. Heating ventilation and air-conditioning property HVAC. Added a new air conditioner to a rental property. The simple answer to this question is no HVAC systems do not qualify for bonus depreciation. Evaporators can be used to absorb heat from air or from a liquid.

Source: scottsdaleair.com

Source: scottsdaleair.com

The changes made by the TCJA apply to property. As for depreciation if they are part of the central HVAC system you have to depreciate them over 275 years. Heating ventilation and air-conditioning property HVAC. The table specifies asset lives for property subject to depreciation under the. Metal stamping and blanking assets.

Source: irishheatandair.com

Source: irishheatandair.com

Friends As per Schedule II to CA 2013 Air Conditioner should be classified as Office Equipment or Plant Machinery If PM will it be in the useful life of 15 years. KBKG Tax Insight. If an AC was purchased at Rs40000 and had a useful life of 4 years and has a salvageable value of Rs4000 then the depreciation will be charged as follows. A business owner installs a new heating and air-conditioning rooftop unit. Just so what is the useful life of an air conditioner for depreciation.

Source: e-education.psu.edu

Source: e-education.psu.edu

Residential rental property or property with a class life of less than 275 years. As featured in AICPA Tax Adviser April 15 2021. However 168e3Eiv provides that 15-year property includes QLIP. Heating ventilation and air. So the first one is a problem with a filter.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title air conditioner useful life depreciation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.