24++ Are energy efficient air conditioners tax deductible ideas

Home » Background » 24++ Are energy efficient air conditioners tax deductible ideasYour Are energy efficient air conditioners tax deductible images are available. Are energy efficient air conditioners tax deductible are a topic that is being searched for and liked by netizens now. You can Get the Are energy efficient air conditioners tax deductible files here. Get all royalty-free images.

If you’re searching for are energy efficient air conditioners tax deductible images information connected with to the are energy efficient air conditioners tax deductible topic, you have come to the ideal blog. Our website frequently gives you suggestions for refferencing the highest quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

Are Energy Efficient Air Conditioners Tax Deductible. Energy-efficient heating and air conditioning systems. Here are the improvements. Did you know that Section 179 of the United States Tax Cuts and Job Act can provide up to a 1 million dollar tax deduction for your costs in upgrading your. Appliance retirement incentives pay cash for old fridges air conditioners and freezers.

Lennox 16acx Air Conditioner From lennox.com

Lennox 16acx Air Conditioner From lennox.com

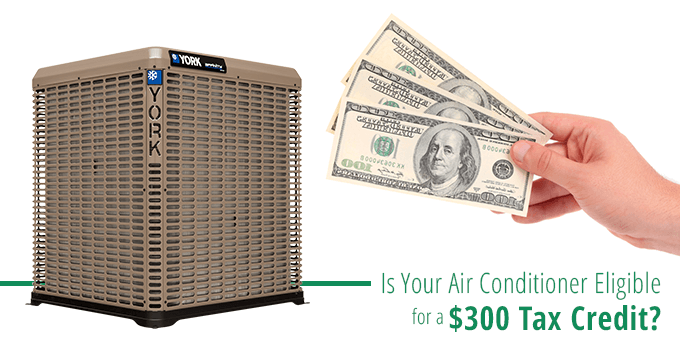

To verify tax credit eligibility ask your HVAC. Appliance retirement incentives pay cash for old fridges air conditioners and freezers. Heres what you need to know about these tax credits. On Apr 08 2010. Central air conditioning 300 tax credit. Taxpayers in Virginia may deduct from their taxable personal income an amount equal to 20 of the sales taxes paid for certain energy efficient equipment.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

Water heaters natural gas propane or oil Biomass stoves qualified biomass fuel property expenditures. You must have a copy of the. When you choose to claim a tax credit. Water heaters natural gas propane or oil Biomass stoves qualified biomass fuel property expenditures. Through the 2020 tax year the. Heres what you need to know about these tax credits.

Source: treehugger.com

Source: treehugger.com

If you have an air conditioning system in your home you may be eligible for a federal tax credit. You must have a copy of the. Taxpayers in Virginia may deduct from their taxable personal income an amount equal to 20 of the sales taxes paid for certain energy efficient equipment. Heres what you need to know about these tax credits. If you have an air conditioning system in your home you may be eligible for a federal tax credit.

Source: walmart.com

Source: walmart.com

Appliance retirement incentives pay cash for old fridges air conditioners and freezers. When you choose to claim a tax credit. Central air conditioning 300 tax credit. In past years as an incentive to conserve energy at home the federal government has offered tax credits to homeowners who purchase energy-efficient appliances. Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for this tax credit.

Source: carrier.com

Source: carrier.com

For qualified HVAC improvements homeowners may be able to claim Internal Revenue Code Section 25C. Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs. The Federal Energy Tax Credit is a program started by the Department of Energy in 2018. If you have an air conditioning system in your home you may be eligible for a federal tax credit. For full details see the Energy Star website.

Source: amana-hac.com

Source: amana-hac.com

The air conditioner must be certified by ENERGY STAR as Most Efficient to qualify for the home energy improvement tax credit. Written by Doityourself Staff. On Apr 08 2010. Heres what you need to know about these tax credits. Through the 2020 tax year the.

Source: kobiecomplete.com

Source: kobiecomplete.com

Here are the improvements. For qualified HVAC improvements homeowners may be able to claim Internal Revenue Code Section 25C. If you have an air conditioning system in your home you may be eligible for a federal tax credit. To verify tax credit eligibility ask your HVAC. Central air conditioning 300 tax credit.

Source: pinterest.com

Source: pinterest.com

Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for this tax credit. Other programs offered include low cost home energy assessments free. Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for this tax credit. Do not include the cost to install these items. On Apr 08 2010.

Source: lowes.com

Source: lowes.com

To verify tax credit eligibility ask your HVAC. Energy-efficient heating and air conditioning systems. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. Qualified improvements include adding insulation energy-efficient exterior windows and doors and certain roofs. Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for this tax credit.

Source: symbiontairconditioning.com

Source: symbiontairconditioning.com

The design was to offer a tax break to homeowners that purchased and. Written by Doityourself Staff. For full details see the Energy Star website. The products listed in the attachment are properly matched with a correct indoor coil andor furnace to achieve the energy efficiency criteria required to qualify. The IRS does not allow you to file a 1040EZ Form or 1040A Form if you also want to claim energy efficiency tax credits.

Source: pinterest.com

Source: pinterest.com

Taxpayers in Virginia may deduct from their taxable personal income an amount equal to 20 of the sales taxes paid for certain energy efficient equipment. Central air conditioning 300 tax credit. Through the 2020 tax year the. The products listed in the attachment are properly matched with a correct indoor coil andor furnace to achieve the energy efficiency criteria required to qualify. Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

Source: pinterest.com

Source: pinterest.com

Here are the improvements. For full details see the Energy Star website. Water heaters natural gas propane or oil Biomass stoves qualified biomass fuel property expenditures. Do not include the cost to install these items. The design was to offer a tax break to homeowners that purchased and.

Source: ar.pinterest.com

Source: ar.pinterest.com

Air-source heat pumps 300 tax. Central air conditioning 300 tax credit. When you choose to claim a tax credit. Through the 2020 tax year the. In past years as an incentive to conserve energy at home the federal government has offered tax credits to homeowners who purchase energy-efficient appliances.

Source: pickhvac.com

Source: pickhvac.com

Heres what you need to know about these tax credits. Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs. Heres what you need to know about these tax credits. Water heaters natural gas propane or oil Biomass stoves qualified biomass fuel property expenditures. For qualified HVAC improvements homeowners may be able to claim Internal Revenue Code Section 25C.

Source: pinterest.com

Source: pinterest.com

Other programs offered include low cost home energy assessments free. Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for this tax credit. When you choose to claim a tax credit. Appliance retirement incentives pay cash for old fridges air conditioners and freezers. Through the 2020 tax year the.

Source: pinterest.com

Source: pinterest.com

Written by Doityourself Staff. If you have an air conditioning system in your home you may be eligible for a federal tax credit. Written by Doityourself Staff. The design was to offer a tax break to homeowners that purchased and. You must have a copy of the.

Source: lennox.com

Source: lennox.com

The design was to offer a tax break to homeowners that purchased and. For full details see the Energy Star website. The design was to offer a tax break to homeowners that purchased and. Other programs offered include low cost home energy assessments free. The air conditioner must be certified by ENERGY STAR as Most Efficient to qualify for the home energy improvement tax credit.

Source: pinterest.com

Source: pinterest.com

Did you know that Section 179 of the United States Tax Cuts and Job Act can provide up to a 1 million dollar tax deduction for your costs in upgrading your. Here are the improvements. Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for this tax credit. Written by Doityourself Staff. You must have a copy of the.

Source: daikincomfort.com

Source: daikincomfort.com

The Federal Energy Tax Credit is a program started by the Department of Energy in 2018. In past years as an incentive to conserve energy at home the federal government has offered tax credits to homeowners who purchase energy-efficient appliances. The Federal Energy Tax Credit is a program started by the Department of Energy in 2018. Through the 2020 tax year the. Written by Doityourself Staff.

Source: amazon.com

Source: amazon.com

When you choose to claim a tax credit. When you choose to claim a tax credit. On Apr 08 2010. Please visit the Rebate Center for a list of energy efficiency tax credits by State. The IRS does not allow you to file a 1040EZ Form or 1040A Form if you also want to claim energy efficiency tax credits.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title are energy efficient air conditioners tax deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.